Start your journey now

5 simple steps in 5 minutes

Aadhar Number + OTP

Enter PAN Number and Bank Account Details

Email Verification and Personal Details

*Document Upload & Selfie Photo

eSign + OTP

Sell your MTF holdings only when you want to.

Up to 66% of the margin will be funded by Navia!

Trade & invest in 1000+ scrips with Margin Trading Facility on Navia.

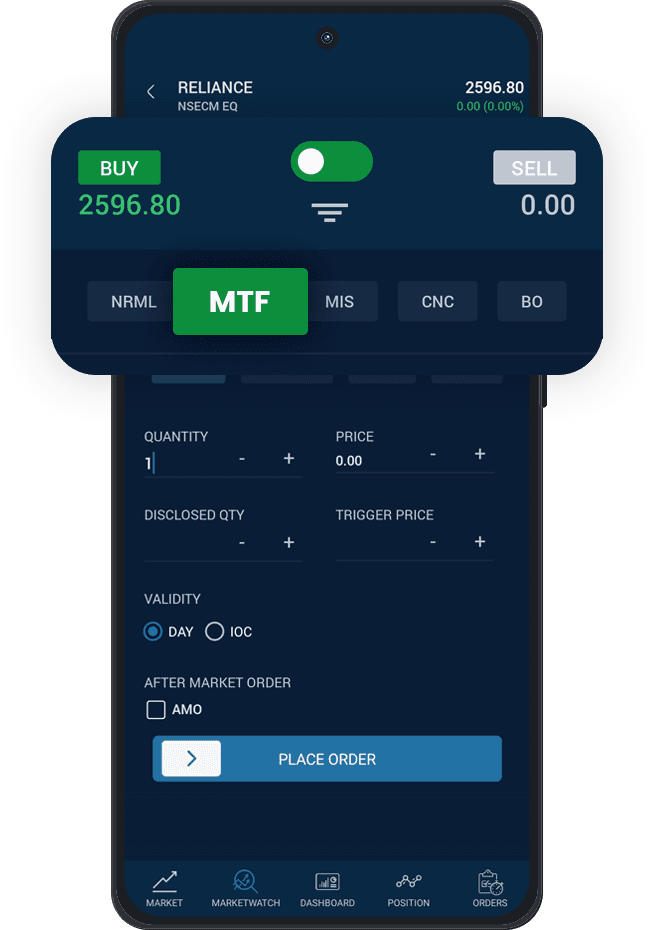

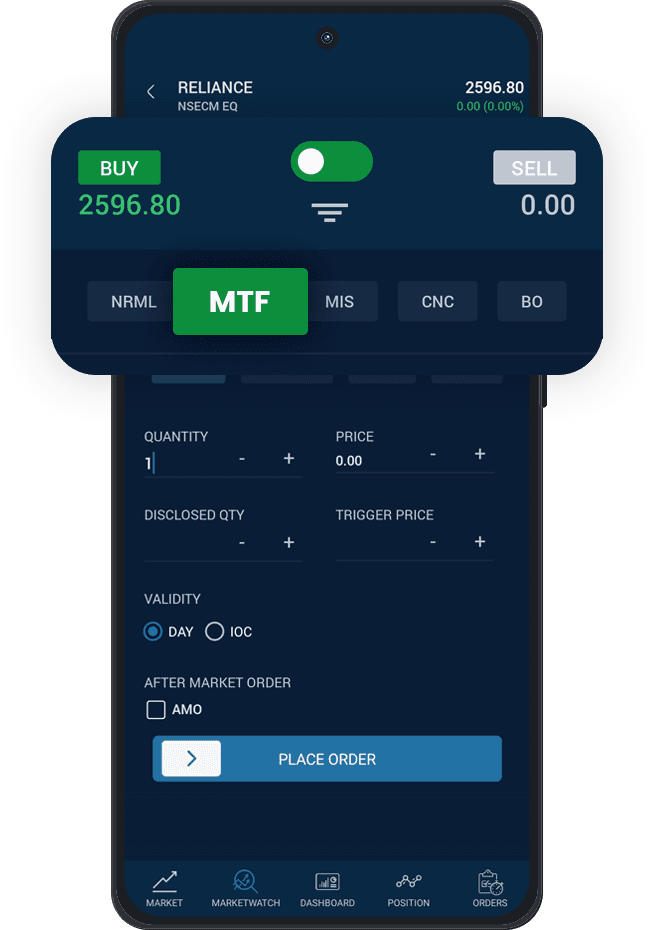

You'll be able to choose MTF in the existing Order Placement flow that's simple & easy!

View shares bought via MTF in a dedicated section in your holdings.

Sell from MTF order screen instantly without the need for separate un-pledging.

Use 3X interest free margins until settlement day.

MTF pledge charge levied once per scrip, regardless of the no. of orders for the same scrip.

You can pledge your holding to get MTF benefits easily.

View all charges and fees.

MTF is active for all Navia Plus users and is visible for all tradeable scrips on the Order window.

Gain from market swings over a short time with limited funds.

Use interest free margins for Buy Today Sell Tomorrow trades.

Buy stocks with a small margin and hold it for the long term.

Margin Trading Funding by Navia allows you to take positions on stocks for a fraction of the total value. The rest? It’s funded by Navia!

The Margin Trading Facility (MTF) enables equity traders to enter into leveraged positions. This simply means that the trader will pay a portion of the position value while the broker will fund the remainder. Navia offers Funding on 1000+ stocks up to 3X

If you have 100000, you can buy stocks worth 300000 with 3X leverage provided by Navia.

Margin trading can be beneficial for swing and BTST traders looking to capitalise on short-term price swings. You can use margin funding to trade with 3x leverage with Navia. You only need to open / activate margin trading account!

Three things to activate the MARGIN FUNDING product.

When using Margin Funding, both cash and non-cash holdings can be used as collateral. Your combined ledger plus pledged holdings would be your available funds for MTF.

Stocks purchased with Margin Funding can be held indefinitely as long as the required margins are maintained on a daily basis.

Select the stocks from your holdings list that you want to put under pledge.

Log in to Navia Plus and request that stocks be pledged as collateral. Watch Video

Alternatively, send an email to [email protected] requesting that the list be placed under pledge.

We will begin the pledging process based on your email or online request. Requests received before 5 p.m. will be accepted for the day.

Once we have completed the Pledge Initiation process, you will receive an SMS from NSDL to your registered mobile number. Check here for more details.

Pledge / unpledge charged at 0.02% of the value of the securities, subject to minimum of Rs. 50/- per Transaction.

While placing an order through Navia Plus, Select the product type as MTF (MARGIN TRADE FUNDING) before you place the order. Check here for more details.

To exit, simply select MTF (MARGIN TRADE FUNDING) order type while selling. No separate un-pledging required.

When you purchase stocks through MARGIN FUNDING, they are uploaded to Backoffice and a forward Pledge request link is created. This link will be sent by email and SMS to your registered contact information.

You MUST accept the Pledge request by clicking on the link before the end of T day. If you did not receive the Email or SMS, please accept the pledge request using the link provided below.:

Without pledge, the purchases under MARGIN FUNDING will be treated as stock purchases in the Normal Cash segment without sufficient funds. As a result, it will be subject to the margin penalty as well.

The shares will be transferred to the Client Unpaid Securities Account (CUSA) as per policy and squared off immediately if sufficient funds are not brought in to cover the purchase.

To deter this, 1% of the pledge transaction value, subject to a minimum of Rs. 50 per pledge request, will be deducted as charges if the pledge link is not accepted within the specified time frame.

Here is a list of stocks that are available for Margin Trade Funding.

An interest of 0.065% will be charged per day on the funded amount.

Yes, you can do BTST on shares bought in MTF. However, there is risk of shares sold before being delivered which has to be borne by the you.